Table of Contents:

Managing collections correctly is one of the most essential tasks for guaranteeing the sustainability and growth of a business. But it is often an aspect that is left for later, or that is not managed optimally, and this can cause cash flow problems, tension with customers and difficulties in maintaining a solid financial structure.

In this article we talk about collection management, why it is vital for the health of your business and the best practices to optimize it. We will also review how technology and banking can be great allies for streamlining this process and making it more effective.

1. What is collection management?

Collection management is a series of actions and processes for ensuring that a company’s customers pay invoices by the dates agreed. It may seem simple: you issue the invoice, wait for them to pay and, if they don’t, you remind them.

In fact, good collection management is much more complex and strategic. It includes defining clear terms with the customer, issuing and sending invoices promptly, constantly monitoring payments, effective and empathetic communication with customers, and handling possible non-payment or deferrals.

It is key for financial planning, reducing risk and ensuring the business is not dragged down by cashflow issues.

2. Why is collection management so important?

Poor collection management can lead to numerous problems that directly affect the health of the company. If payments are delayed or do not arrive, the company may struggle to pay staff and suppliers or meet other financial commitments. This can create a chain of problems that impact the company’s reputation and even its continuity as a business.

If payments are not received on time, the business may have to draw on external financing to cover the lack of liquidity, which means additional costs and greater dependence on third parties.

However, well-organized payment collection management brings many advantages:

- Stable cash flow. Knowing when you will receive money helps you plan expenditure and investments better.

- Better customer relations. Respectful professional monitoring avoids conflict and increases trust.

- Reduced operating costs. Automating processes and avoiding unnecessary manual operations makes everything more efficient.

- Controlling the risk of defaults. Identifying possible risks and acting on them in good time avoids unpleasant surprises.

3. The keys to optimizing payment collection management

The main strategies you can implement to improve this critical area of your business are:

1. Define clear terms from the beginning. Before starting any business relationship, make sure the payment terms are explicit and accepted by both parties. Specify payment dates and methods, possible discounts for early payment and penalties for late payment. Including these clauses in contracts avoids misunderstandings and makes subsequent management easier.

2. Issue invoices quickly and accurately. Common mistakes include sending invoices late or with errors that raise doubts and lead to delays in payment. The faster and more accurate your invoicing process is, the more likely it is that the customer will pay on time.

3. Follow up proactively on payments. Don’t wait for the invoice due date to contact the customer. Schedule friendly reminders that the payment date is approaching. Communication must be professional and empathetic, explaining that you understand possible difficulties but remaining firm. This monitoring prevents payments from being lost among the numerous invoices managed by the client.

4. Train your team. The staff who manage payment collection must have communication skills and empathy, but also need financial and business knowledge. Good training allows you to deal with each situation professionally, and know when to insist and when to make concessions.

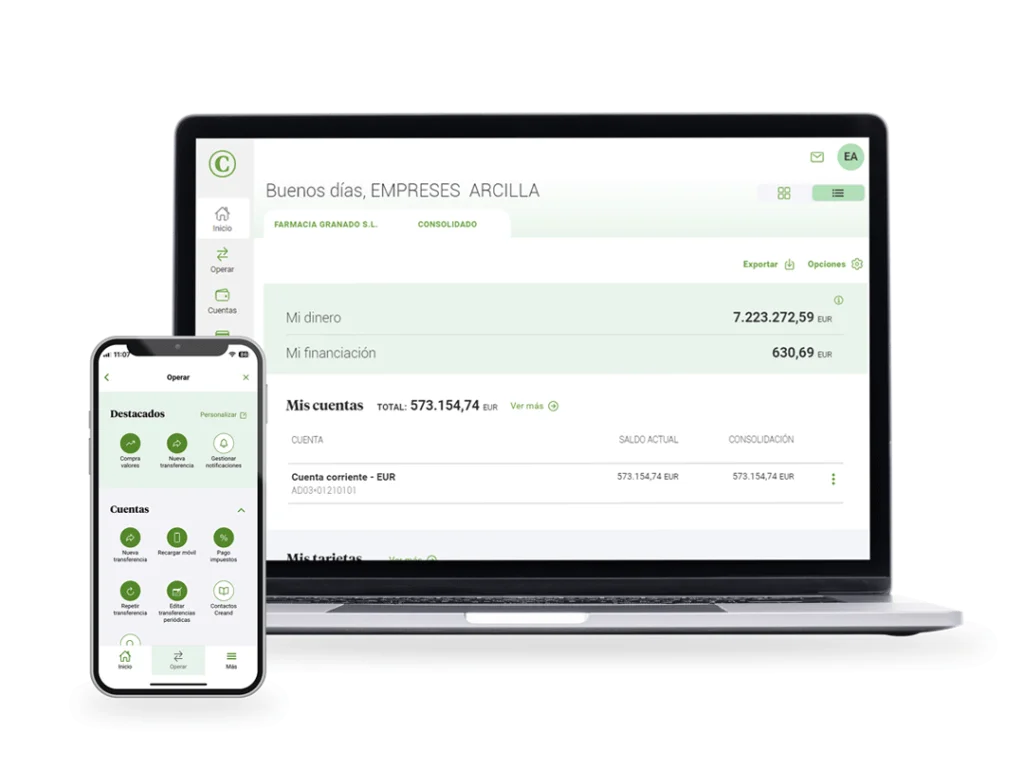

5. Automate processes with technology. Specialized tools and platforms can automate the sending of invoices and reminders, allow you to monitor payment in real time, generate detailed reports and integrate the entire process into your ERP (Enterprise Resource Planning) or CRM (Customer Relationship Management) systems. This reduces the administrative burden, minimizes human error, and improves the company’s efficiency and employee productivity.

4. Preventing problems before they happen

Prevention is always better than cure. For this reason, implement the following best practices:

- Classify customers according to risk. Not all customers behave in the same way or have the same ability to pay. Classify them and adapt your management approach to each one’s profile.

- Diversify payment methods. Offer options such as bank transfers, card payment, digital platforms such as Bizum, and online payment. This increases the likelihood of quick payment.

- Set credit limits. Assign maximum debt limits according to each customer’s record and solvency.

- Record and analyse data. Monitor and analyse incidents to detect patterns and anticipate future problems.

5. The role of banks in collection management

ElsBanks offer numerous services to streamline invoice collection and make it easier:

- Direct debit. Automates the collection of regular payments.

- POS and payment gateways. These allow you to receive electronic payments easily, even remotely.

- Managing trade receivables. The use of batch billing, promissory notes and trade bills can help you to organize and control payment collection.

- Automatic reconciliation of bank transactions. Identify actual payments and compare them with outstanding invoices to detect discrepancies quickly.

Working with a bank and using these integrated services provides greater control and security.

6. Do you need immediate liquidity? Find out about trade discounts andfactoring

If your business needs cash ahead of the agreed payment date, there are two options that can save you money:

Bill discounting. You obtain advance payment of a bill of exchange, trade bill, invoice or promissory note from a financial institution that charges commission and interest for this service.

Factoring. You assign all or part of the invoices to a bank or financial institution specializing in business financing, which manages them, advances payment to you and even assumes the risk of non-payment.

These solutions are very useful to avoid stress and guarantee liquidity at specific times.

7. Make payment collection management a strategic priority

Payment collection management is not just an administrative issue, but a fundamental strategy to ensure the financial health of your company. With a well-structured plan, a well-trained team, technological tools and the assistance of a bank, you can ensure trust and stability in payment collection.

Remember that being paid on time helps you to take care of your relationship with customers and preserve the future of your business. Don’t let it become a problem: act early and with professionalism.

If you want to learn more about how to implement these measures or need help digitizing and optimizing your payment collection process, do not hesitate to contact your account manager. With our support your business will become more efficient and you will have peace of mind.